Welcome to ProfiComment! In this article, you will learn about the financial markets of the United States. You will learn what people are selling and buying in these financial markets (exchanges)? How they earn?

Welcome to ProfiComment! In this article, you will learn about the financial markets of the United States. You will learn what people are selling and buying in these financial markets (exchanges)? How they earn?

Exchanges is a legal entity or, more simply, an organization that ensures the functioning of the commodity market. Exchange commodities are:

- Currencies,

- Securities (for example, shares, common stock, futures, bonds, options, bills of exchange, traveler’s checks),

- Derivatives of financial instruments (agreements, contracts).

Next, let’s talk about what types of exchanges are, and a detailed look at US stock exchanges.

List of US stock exchanges

On the stock exchanges, people buy and sell securities. Securities include: bonds, shares, deposit receipts and other assets.

In total in the USA there are two largest stock exchanges:

- New York Stock Exchange (NYSE). This is the main US stock exchange.

- Located on Wall Street, 11 (New York City, Wall Street, 11). At the world level, this is the largest exchange.

- NYSE Founded 225 years ago, on May 17, 1972.

- More than 3,000 companies are represented on the stock exchange.

- Capitalization of the exchange is more than 20 trillion dollars.

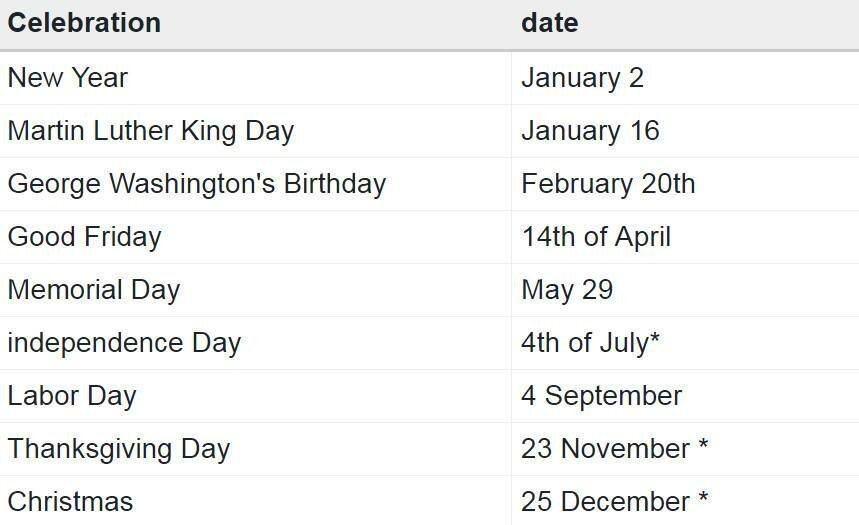

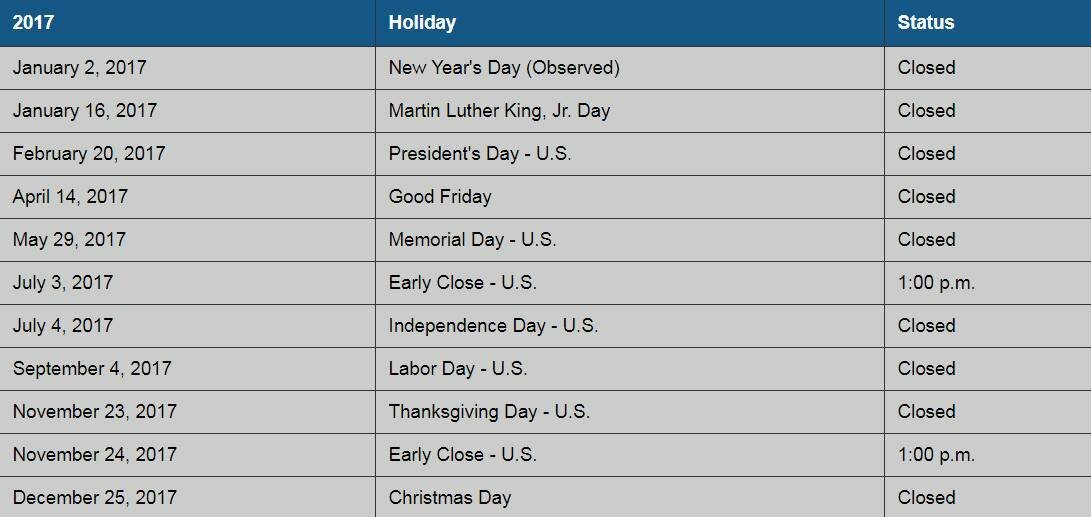

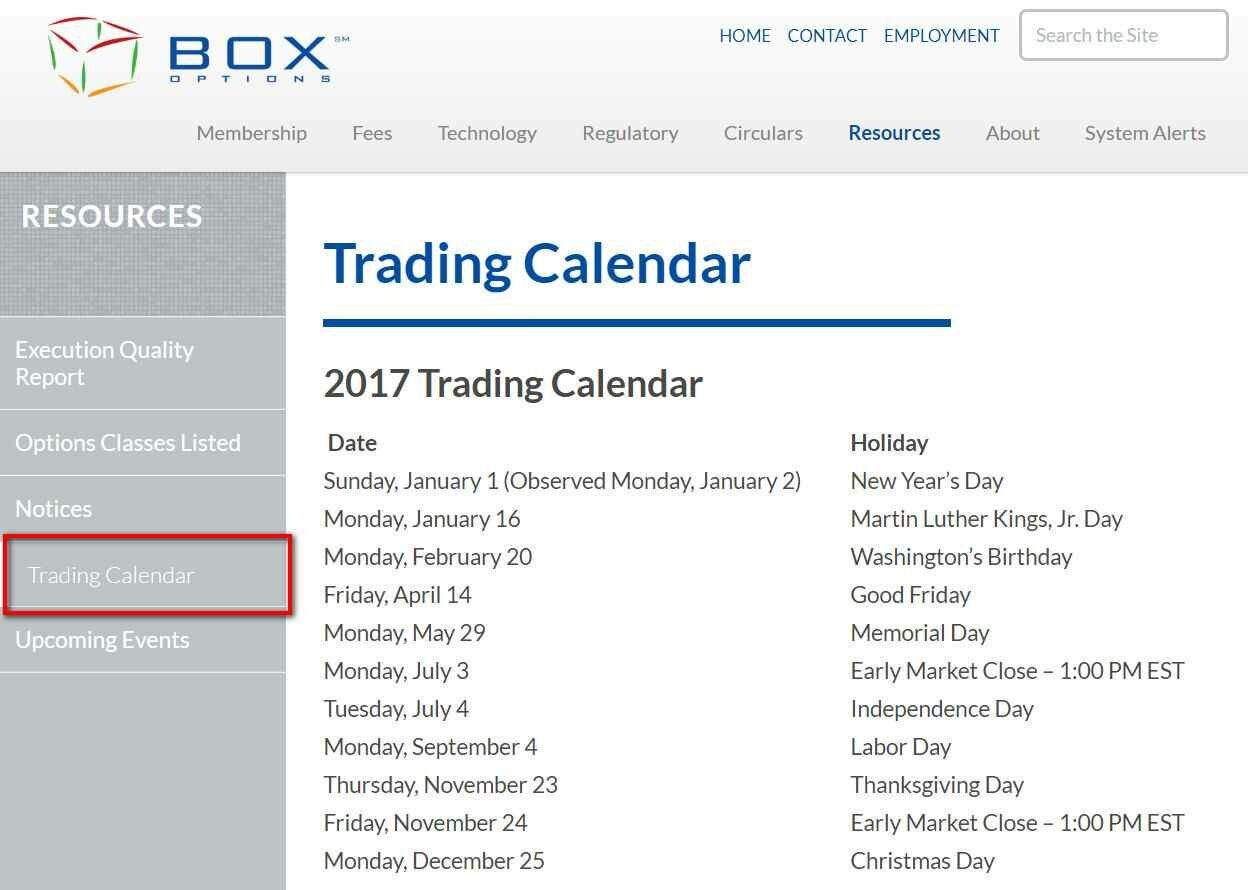

On the New York Stock Exchange, you can trade in the hall of the exchange itself and remotely via the Internet. The exchange operates 5 days a week from Monday to Friday, from 9:30 to 16:00 on NY Time (EST, Eastern Standard Time). Non-working days are 9 more days a year.

On the US financial markets, the day preceding Independence Day and the day following Thanksgiving Day is the reduced working days to 13:00 EST.

- NASDAQ (National Association of Securities Dealers Automated Quotation).

- NASDAQ is on Broadway, 165 in New York.

- The Exchange was founded in 1971.

- As of 2017, on the NASDAQ Stock Exchange trades about 3200 companies.

- Capitalization of the exchange is almost 7 trillion dollars.

Weekend holidays NASDAQ can be viewed in this table. However, it is necessary to follow up-to-date information on the official website of the exchange.

List of US currency exchanges

- Forex is a global twenty-four-hour currency exchange. Forex is an international interbank market.

- Participants of Forex are central and commercial banks, investment banks, brokers and dealers, transnational corporations, insurance companies, etc.

- Forex does not have a single control center. This is a decentralized currency exchange.

- Forex emerged after US President Richard Nixon abandoned the gold standard. The exchange rate became floating. This led to a new type of activity – currency trading.

- The daily money turnover on Forex is about 5 trillion dollars (data for 2016).

Since Forex is a decentralized currency market, it does not have an official website. You can get to this market only through brokers who cooperate with banks.

Banks are major players in the market. All exchange rates in the world depend from the deals that banks make between themselves.

Bank for International Settlements (BIS) is analyzing the Forex Market. This is an international financial organization. It cooperates with central banks of different countries and promotes cooperation between them.

Every three years BIS makes a global Forex survey and posts the report on its official website.

List of US commodity exchanges

On commodity exchanges, people sell and buy different goods. As a rule, these are interchangeable and homogeneous goods. However, commodity exchanges are divided into 2 types:

Universal exchanges

On exchanges of this type, a universal product is bought and sold. For example, crops (corn, wheat, oats, soybeans and butter), gold, silver and securities.

- Chicago Mercantile Exchange (CME).

- Founded in 1898.

- Located at: 550 W Washington Blvd, Chicago, IL 60661, USA.

- The trading volume on the stock exchange is more than 500 million contracts. And on the electronic trading platform Globex – more than 300 million contracts.

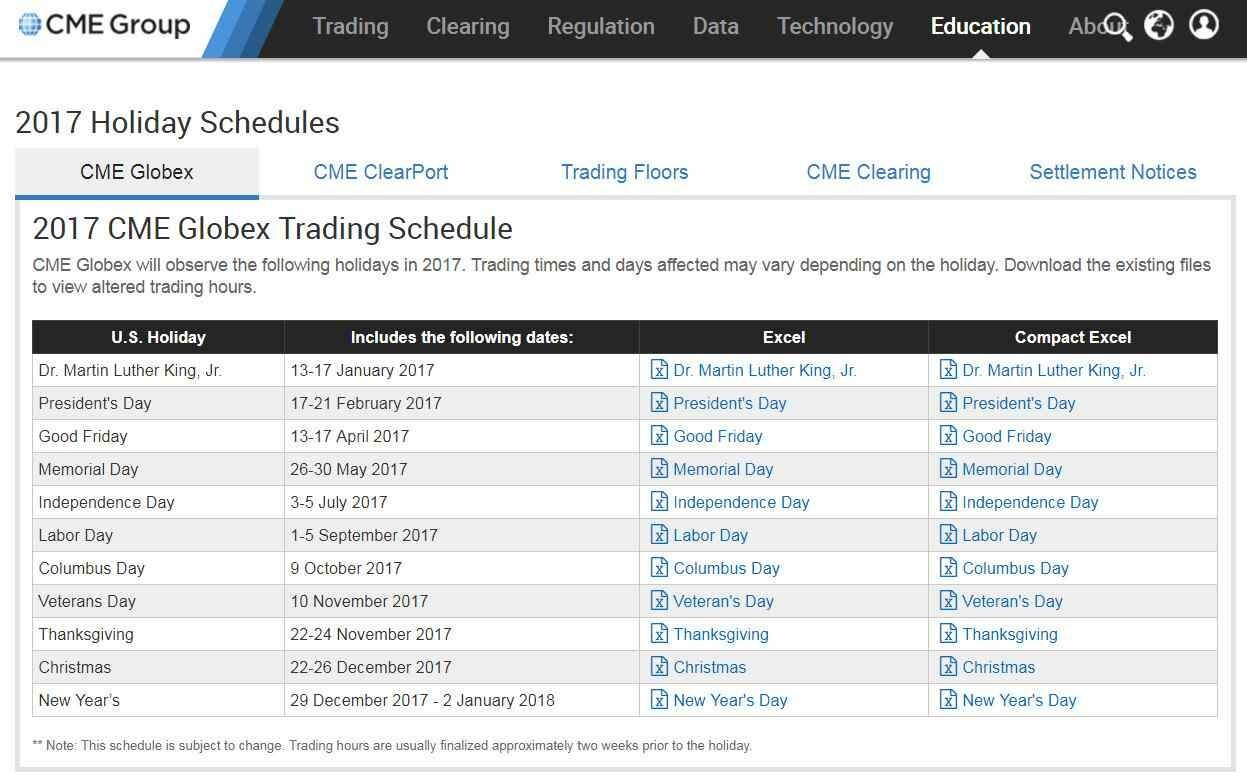

- You can trade on the stock exchange in two ways: on the territory of the Exchange building (on the trading floor) and via the Internet using the CME Globex electronic platform.

- The Chicago Mercantile Exchange and Chicago Board of Trade have merged into the CME Group in 2007.

On the electronic trading platform Globex, the trade goes around the clock with a break of 1 hour. Information about holidays and weekends can be found on the website of the trade exchange. The schedule can change, therefore for the actual information it is necessary to address in the section “holiday calendar”.

- Chicago Board of Trade – CBOT. Since 2007, together with the Chicago Mercantile Exchange, have been merged into the CME Group. On the trading platform CBOT, you can buy / sell futures and options of grain, soybeans, gold, silver, shares, securities of the US federal treasury. The largest volume of trade is accounted for by treasury obligations and agricultural products.

- Located at: 141 W Jackson Blvd, Chicago, IL 60604, USA.

- Chicago Board of Trade founded in 1848.

- The total capital of the CME Group is more than $ 20 million as of 2016.

- Trading on the stock exchange is possible on the trading floor by means of a voice (open outcry), as it is done by about 3,600 exchange members. And also via the Internet using an electronic platform. You can find it on the official website of CME Group.

Specialized exchanges

On exchanges of this type, you can find products of narrow commodity specialization. For example, non-ferrous metals, coffee, sugar, cocoa, cotton.

- New York Mercantile Exchange (NYMEX). This is the futures exchange, which takes the leading place in trading oil futures. In 2008, NYMEX joined the group of the Chicago Mercantile Exchange CME Group.

- Founded in 1882.

- In 2016 more than 200 million transactions were made on the stock exchange.

- Сapitalization of NYMEX is about 11 billion dollars.

- The exchange has two divisions: NYMEX and COMEX (in 1994 the exchange merged with COMEX – Commodity Exchange).

- NYMEX specializes in trading in oil, gas, electricity, coal, platinum, palladium, ethanol.

-

COMEX – on this exchange you can buy or sell gold, silver, as well as non-ferrous metals – aluminum and copper.

cmegroup.com – COMEX - Coffee, Sugar and Cocoa Exchange

- New York Cotton Exchange

List of US options exchanges

On the stock exchange, you can buy and sell options.

What it is?An option is an agreement, a contract. Under this agreement, the buyer has the right,but he is not obliged to make a future purchase of the asset or its sale at a certain price. The seller under the option contract is obligated to sell this product to the buyer or to buy another asset in return. Оptions and futures are similar, but they have fundamental differences. Futures is a contract whereby the seller and the buyer are liable for its execution. An option is a contract that gives the buyer the right to refuse in the future from buying an asset. Buying an option from the seller, the buyer leaves a pledge in the form of a sum of money. If the buyer in the future will not be profitable to acquire the asset, then he can refuse to purchase, and the pledge remains with the seller as compensation. In the US there are 2 large option exchanges:

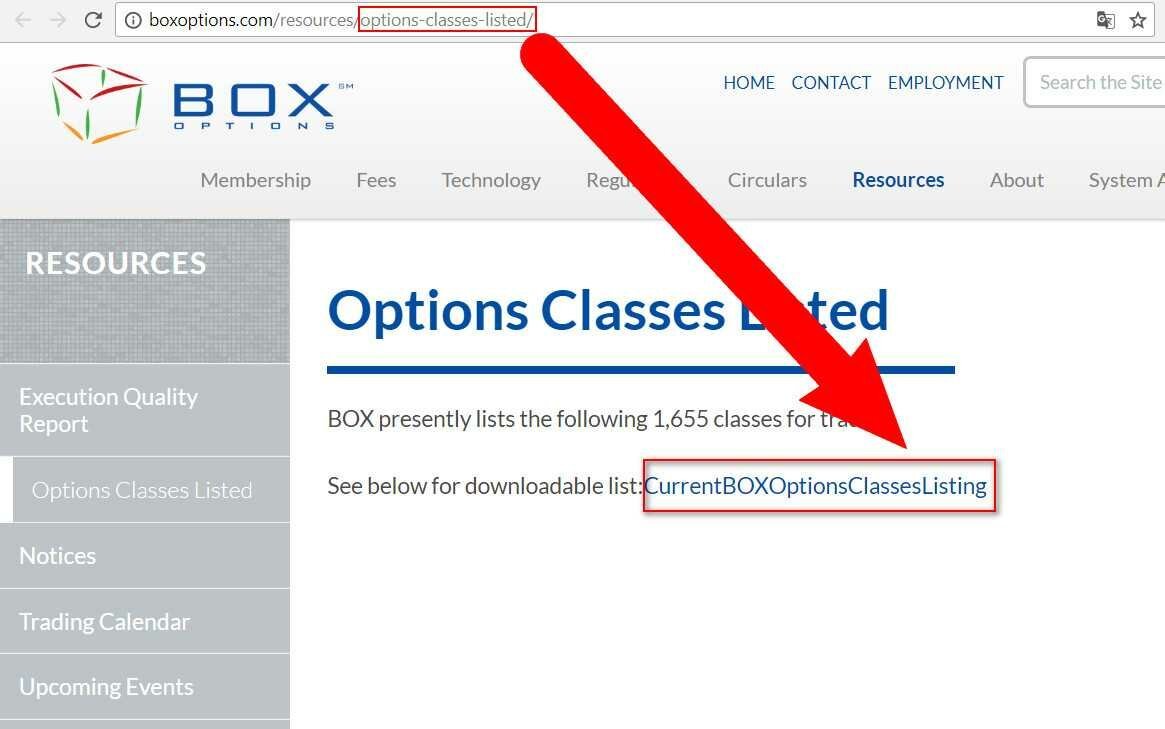

- BOX Options Exchange – automatic exchange. It is under the management of TMX Group.

- Founded in 2002.

- Located in Boston, Massachusetts.

- Trade in the market you can only in electronic form.

- For the convenience of trade, more than 1500 classes of options are available. You can see the list on the official site.

On the site you can find information about the weekend of the exchange:

- Chicago Board Options Exchange. On this exchange, stock index options are very popular. Also on the exchange, you can buy or sell options on interest rates, options for indices of foreign shares, options for industry indices.

- This exchange was founded in 1973. It is a subsidiary of the Chicago Board of Trade CBOT (about it was written above).

- Half of the US option trade (51%) is currently taking place on this exchange. 91% are all options indices.

- Market participants are brokers and market makers.

- You can trade on the exchange via the Internet using a special electronic platform.

List of US futures exchanges

On the futures exchange you can buy and sell futures. Futures is an agreement, a contract. The seller of the futures undertakes to sell, and the buyer of the futures undertakes to buy in the future the goods at a certain price. Futures relate to a derivative financial instrument. Let’s look at the list of US futures exchanges. Please note that in this list there will be those exchanges that were listed above. The fact is that, for example, on the Chicago Board of Trade, you can buy or sell futures for the purchase of different goods, not just goods. The same with other exchanges.

- CME Group Inc. (Chicago Mercantile Exchange & Chicago Board of Trade). This is the largest market of financial derivatives in the US.

- CME Group Founded in 2007.

- The total capital is about 20 million dollars.

The CME Group includes the following exchanges:

- International Monetary Market (IMM). This is the largest futures exchange in the US. Here, people buy and sell futures for interest rates, futures on futures, US Treasury bills, deposits in eurodollars.

- Chicago Board of Trade CBOT. Read about it above.

- Chicago Mercantile Exchange, CME. Read about it above.

- New York Mercantile Exchange (NYMEX) and its subdivision COMEX. Read about it above.

-

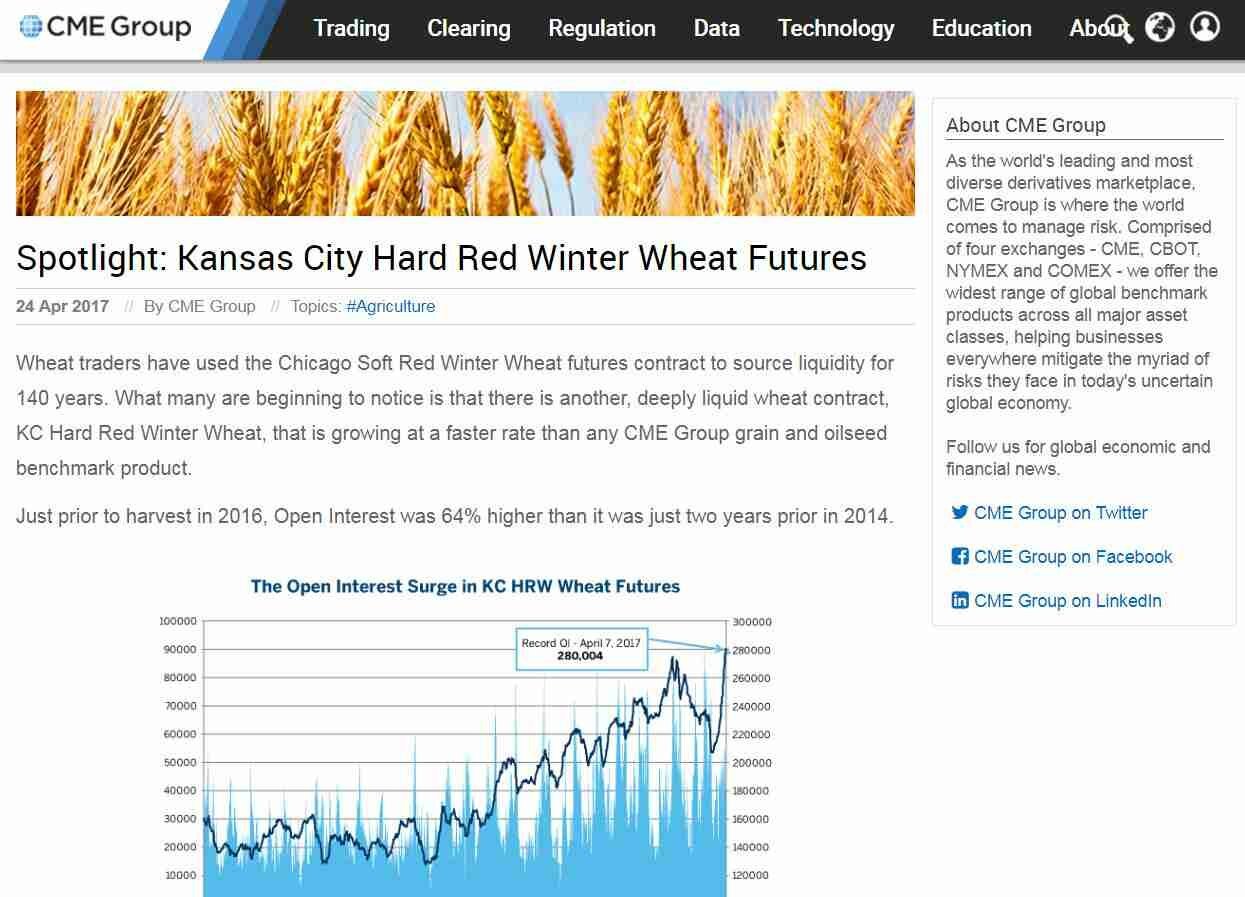

Kansas City Board of Trade (KCBT). It was founded in 1856. On the exchange, the purchase and sale of futures of hard red winter wheat was carried out. Now this exchange has ceased its activity, as it was acquired by CME Group.

Kansas City Hard Red Winter Wheat Futures

- Chicago Board Options Exchange. Read about it above.

- Chicago Climate Exchange (CCX). It was founded in 2003. To date, this exchange has already been closed since 2010.

-

Intercontinental Exchange (ICE). This network of exchanges around the world (USA, Canada, Europe).

theice.com

- On the intercontinental exchange, you can buy or sell futures of different assets: energy, precious metals, currencies. 50% of world trading on the stock exchange – oil and oil products.

- Founded in 2000.

- Located in Atlanta, USA.

Let’s look at which US exchanges belong to this world Intercontinental Exchange:

- New York Board of Trade (NYBOT).

- Since 2007, renamed ICE Futures US.

- This exchange is located in the Mercantile Exchange building in Manhattan, in the World Financial Center.

- Goods that can be bought or sold on the exchange: sugar, pulp, orange juice in the form of frozen concentrate, cotton, coffee, cocoa.

- Exchange is a physical place for the exchange of futures in New York.

- Located in New York Mercantile Exchange Building, is One North End Avenue, New York, NY 10282-1101.

- NYSE Euronext – group of companies. It consists of two exchanges NYSE and Euronext.

- In 2013, the Intercontinental Exchange acquired the NYSE Euronext.

- To see the work of this exchange, you can visit the official website

euronext.com - Trading on the exchange is possible via the Internet through a special trading platform Optiq.

- Nasdaq Futures Exchange (NFX).

- About the Nasdaq exchange read above.

- Nasdaq Futures Exchange is a branch of the Nasdaq exchange itself.

- With the help of an electronic trading platform, you can buy different futures for: gas, oil, US power.

business.nasdaq.com

- Minneapolis Grain Exchange (MGEX).

- It was founded in 1881.

- On this exchange, you can buy futures and options for hard red spring wheat, hard red winter wheat, soft red winter wheat, corn, soybean.

- Earlier on the stock exchange it was possible to trade in the hall of the building itself. Now the trade is carried out only through the Internet with the help of the trading platform CME Globex.

mgex.com

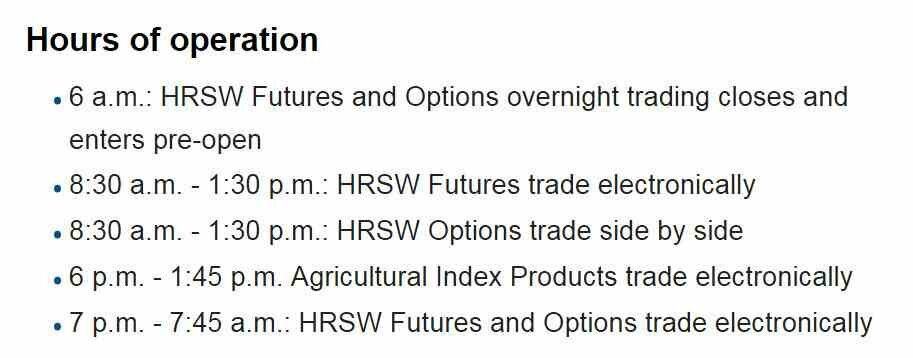

You can see the time of work in the table. However, you should look up the actual information about the time of the operation of the exchange on the site.

- Northern American Derivatives Exchange (Nadex).

- Previously it was known as HedgeStreet.

- Founded in 2004.

- The main office of the exchange is located in Chicago, Illinois, USA.

- The exchange trades in binary options and spreads sold in the stock index markets, commodities, Forex.

Trading on the stock exchange takes place through a trading platform on the Internet. More information can be found on the NADEX website.

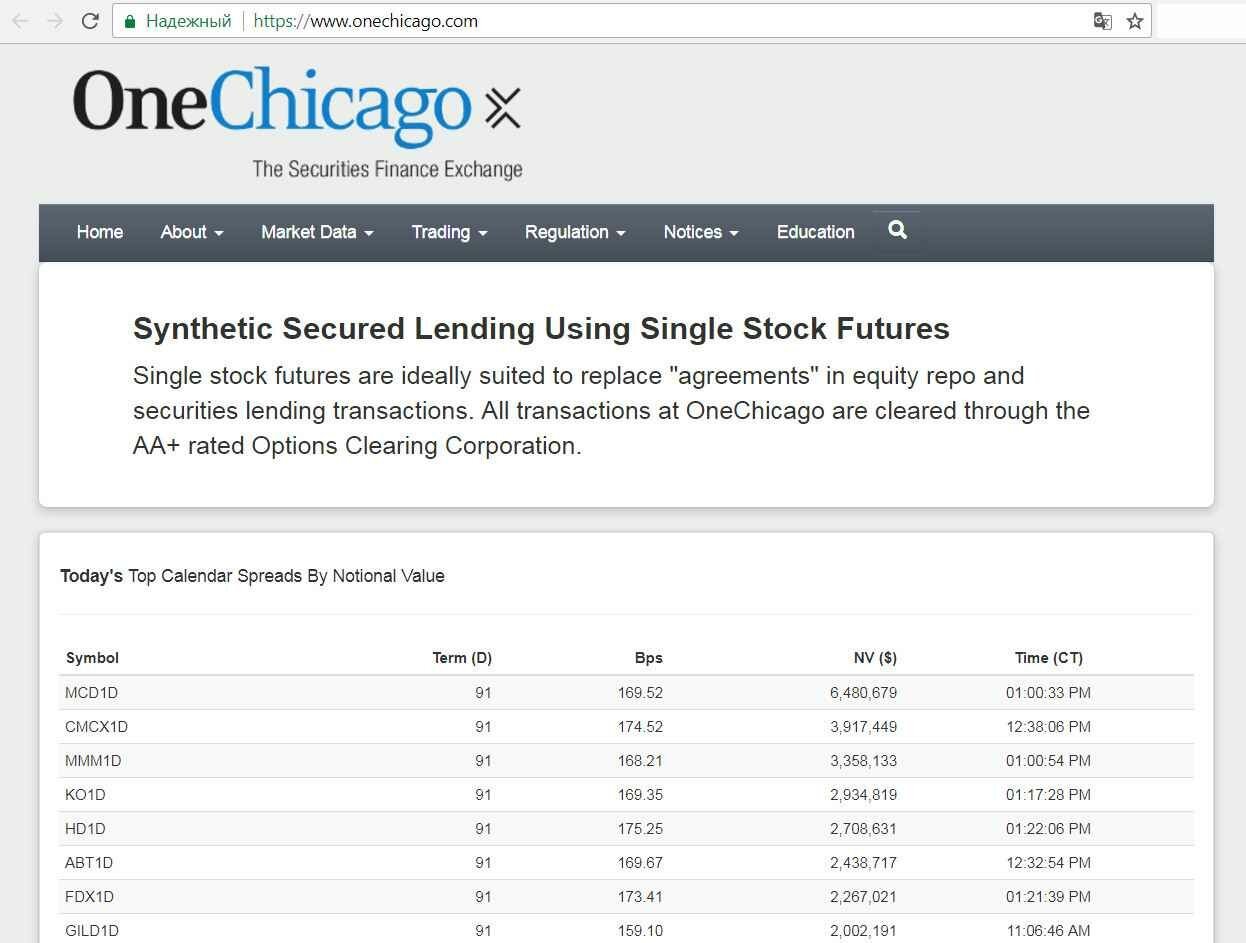

- OneChicago – electronic futures exchange. The exchange belongs to several groups of companies: IB Exchange, CBOE Holdings, CME Group. During the year, the exchange sells about 1.5 million contracts..

- Trading on the exchange is carried out on the trading platform OCXdelta1. In it you can customize your own graphical interface.

- On the exchange OneChicago is offered about 13 thousand futures on security (data of 2016). About 2500 futures on exchange funds and about 2000 on OCX.NoDivRisk.

- Members of such exchanges as CME Group and CBOE automatically become members of OneChicago and can carry out the sale of futures for this exchange (in order to purchase futures for security, you need to obtain a permit).

Glossary of terms

Bond is a security paper. The person who buys the bond, in the future has the right to receive on its basis in the specified term money or other property. All this is prescribed in bond.

Bonds are issued most often by an organization in order to obtain financing from individuals for the development of a project. To put it even simpler, the bond confirms that its owner lent money to the organization.

The yield of a bond is interest. A bond does not make a person a co-owner of an enterprise. On a bond, a person receives interest and, ultimately, the company must return the value of the bond itself. At the exchange, the value of bonds can fluctuate. If it falls below the price that the enterprise must pay in the end, then buying such a bond can give additional profit.

Example: the organization issued bonds at a price of $ 10. For each bond there is a profit of 2% per annum. The bond is purchased by a person for a period of 20 years. On the exchange, the share price may drop to $ 5. However, it states that the company should eventually return $ 10.

Accordingly, to buy bonds on the exchange for $ 5 is beneficial, because they can get guaranteed $ 10, but through the term prescribed by the contract. Plus, each bond brings interest to its owner every year.

Share is a security, which makes a person co-owner of the company and allows him to profit (dividends) from the company’s activities commensurate with the number of shares acquired.

The owner of the shares can take part in the voting. Companies issue shares to get money for development. And, by selling shares, the company does not take money on credit. Dividends, this is the interest on profits that are paid to the owners of shares one or several times a year. If the company does not have profits, then there are no dividends either.

Which is better – shares or bonds?

Bonds allow a person to get a small profit from the organization on the basis of a contract regardless of the economic state of the enterprise. Even if the company goes bankrupt, it must pay the loan amount stipulated in the bond. A bond does not make a person a co-owner of a company, but makes it a small creditor. However, it is necessary to carefully study the conditions in bonds to understand their benefits.

Shares make the person a co-owner of the company. He can receive dividends, take part in voting, but if the company becomes bankrupt, the share price will fall, the dividend amount will decrease and it will be more difficult to sell the shares in order to return the invested money. However, if the shares are acquired successfully and invested in a prospective enterprise, then it is possible to make good money faster than on bonds.

Therefore, it is profitable to buy shares when there is confidence in the sharp economic growth of the new company.

Bonds are advantageous if they are issued by stable companies that are engaged in the creation or production of something very necessary all over the world (they have a stable demand for their goods or services). This ensures that in 10-20 years, such companies will be able to pay interest on bonds. They can be relatively small – 3-5% per annum. Therefore, investing money in bonds is a long-term investment, which pays off not immediately.

Futures is a contract. The seller of the futures must sell, and the buyer of the futures must buy something after some time, prescribed in this contract. Performing of futures is the responsibility of the buyer and seller. Refuse to futures obligations can be, but this is a separate legal topic.

Example: there is some goods, but in the future – grown potatoes or caught fish. The buyer and the seller enter into a contract that in a month they will conduct a purchase transaction at a certain price for the goods.

What is the benefit of futures? The benefit for the seller is that he gets a guaranteed buyer in the future. The benefit for the buyer is that he will sign a contract for a certain price in the future. Since the prices of goods can grow compared to the present, the buyer thus fixes the value of the future product.

Option is a contract for the purchase and sale transaction in the future (similar to futures). However, in this case the buyer receives not the obligation, but the right to purchase for the goods (service) in the future. A seller must sell the goods to the buyer.

The buyer at the time of buying the option gives the seller some money. If he refuses in the future from a product or service, then the pledge money remains with the seller as compensation.

Example: a man wants to invite a woman to a movie. But he is not sure that she will be free on this particular day. A man book seats in the cinema for a little money, so as not to buy tickets, and as a contract, he receives a check. If a woman will be free, and they’ll go to the movies, then this option will be exercised. If the plans break, then the theater will have compensation money.

The advantage of the option is that in the present time the buyer insures himself against unforeseen circumstances in the future when buying goods (for example, a price jump).

Example: a person wants to buy a car. But he will have money only in a week. The seller and the buyer make a preliminary contract of sale, in which the buyer gives the seller a deposit, and the seller agrees to the contract, sell the car in a week. If the buyer refuses to buy or he receives no money, the pledge remains with the seller as compensation. The contract of sale was an option.

With you was Mary Click, good luck!